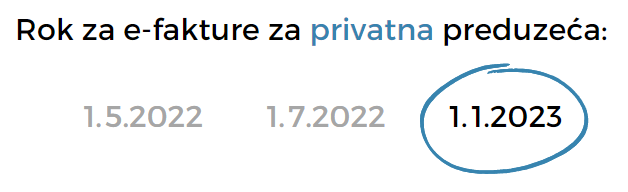

Electronic invoices law: What you need to know - 1.1.2023

This is an important blog post for businesses in the private sector sector in Serbia because it shows details of the new e-invoice legislation that comes into effect power for private sector entities on January 1 2023. This electronic invoice law with you brings many changes for which businesses would should be prepared. In this article we will discuss what the new law entails and how companies can comply with it. Too, we will show a suitable solution that companies can use to create and deliver e-invoices to portal of the National Tax Administration. Stay updated for more information as we near the end by January 1!

Electronic invoices law - quick checklist

This checklist gives owners of private businesses a quick overview of everything they need to do regarding the new e-invoicing and how it affects their business.

- Do you send invoices to the public sector?

NO - Continue reading

YES - You are obliged to send e-invoices to the public sector from 1.5.2022

- Do you receive invoices from the public sector?

NO - Continue reading

YES - You are obliged to receive e-invoices from of the public sector from 1.7.2022

- Are you doing business with someone who already has e-invoicing solution?

NO - Continue reading

YES - From 1/7/2022 you are obliged to receive everything e-invoices sent via SEF

- Are you a lump sum obligor?

NO - Continue reading

YES - Visit the article about flat-rates and e-invoices for more information

- Are you a private sector entity?

YES - You are required to send e-invoices to everyone to members of the private sector from 1.1.23. Keep reading to learn more, because we present the main points of the new law.

NO - You do not need to read this article

Main dates:

1.1.2023 - B2B (implemented)

- Private sector entities will have to issue an electronic invoice to the subject private sector

1.7.2022 - G2B (entered into force)

- Public sector entities will have to issue an electronic invoice to the subject private sector

- Private sector entities will have to accept and maintain electronic invoices issued by public sector entities and electronic invoices issued by entities private sector.

1.5.2022 - G2G and B2G (entered into force)

- Public sector entities will have an obligation to receive and store electronic invoices issued in accordance with the law and the obligation to issue an electronic invoice to another entity public sector

- Public sector entities will have the obligation to electronically record the tax on the added value in the sense of Article 4 of the Law

- Private sector entities will by law be obliged to issue electronic invoice to a public sector entity.

Who, by law, is obliged to issue e-invoices?

In accordance with Article 3 of the law, they are obliged to issue electronic invoices:

- private sector entities based on mutual transactions and based on transactions with public sector entities;

- tax representative of a foreign person in the Republic Serbia, in terms of the regulations governing it value added tax, based on dealings with private and public entities sector.

Who is not obliged by law to issue e-invoices?

Exceptionally, there is no obligation to issue electronic invoices for:

- retail trade and advances received for retail trade in accordance with the law which fiscalization is regulated;

- contractual obligation that is intended recipients of international funds framework agreements;

- procurement, modernization and overhaul of weapons and military equipment, security procurement sensitive equipment and related procurement of goods, services or works.

What this e-invoice law means for you and yours the business?

From 1.1.23 all business owners will have to send e-invoices in SEF, the portal of the national government, u in accordance with Art. 3. and 4. of this law, which serves as a place of exchange for all e-invoices in the country. From the SEF Your client can take an e-invoice and process it, so that the whole circle is completed. For that You need a suitable solution for e-invoicing and connection to SEF.

Check out our step-by-step instructions for registration on SEF and connection to ours solution. With it you can switch to e-invoices in less than half an hour.

Implementation of e-invoices in your company all paper invoices and .jpg or .pdf invoices invalid and must be issued in .XML form i send to the SEF portal. Due to the nature of electronic invoice invoicing costs will be considerable discounted, 60-80% compared to normal invoicing on paper. Read more about the profitability of switching to e-invoices.

How much are the fines?

Penalties for non-compliance with the new law range from 50,000 to 2,000,000 RSD

The most important thing that members of the private sector need to know is:

- 200,000 to 2,000,000 RSD will be legally fined person - subject of the private sector, that is public company if: violates the obligation does not record the issuing of electronic invoices value added tax electronically in in accordance with this law, uses data that are available in the system of electronic invoices in purposes that are not prescribed by law, do not receive electronic invoice in accordance with this by law.The entrepreneur - subject will be additionally fined private sector with a fine in the amount from 50,000 to 500,000 dinars and a responsible person legal entity - subject of the private sector, that is, a public company, with a fine of 50,000 to 150,000 dinars.

- 200,000 to 2,000,000 RSD will be fined for offense legal entity - private subject sector if it does not store the electronic invoice in in accordance with this lawIn addition, the responsible person will be punished by legal persons - subjects of the private sector in cash with a fine in the amount of 50,000 to 150,000 dinars and an entrepreneur - a subject of the private sector - with a fine in the amount of 50,000 to 500,000 dinars.

How to comply with the new electronic law invoice?

In order to comply with this new law, you have to find a suitable solution that will help you to create, send and archive e-invoices.

We have developed electronic invoice solution who is:

- is 100% compliant with the new Serbian law for electronic invoices

- allows you to create e-invoices for a few seconds

- to send e-invoices to SEF with one click

- to receive e-invoices from SEF automatically

- to archive e-invoices for up to 10 years

For users: possible ERP, CRM, connections with any type (even with legacy ERP for which there is none way to match e-invoices)

For developers: we also created a lot APIs for e-invoicing integration (Menu: For developers) to get your software in in accordance with the e-invoice. Check out our homepage page.

More about solution for electronic invoices.

Register now here for 30 days FREE

After registration, take a look at our step-by-step instructions for registration on SEF and connecting to our solution. With him you can switch to e-invoices in less than half an hour.

Frequently asked questions

- SEF has its own free solution to manual entry to be consistent, why use your service?

The SEF version is suitable for users with a very minimal number of e-invoices and allows personal input only. Ours the solution was developed through 15 years of experience with the e-invoicing sector and made is for professionals and companies for whom it is need a comprehensive solution for e-invoicing.

- What is the storage period according to the new law electronic invoices?

SEF permanently stores electronic invoices issued or received by public entities sector. Obligation to keep e-invoices issued i received by the private entity sector is 10 years from the end of the year in to which the e-invoice was issued. With our solution you get that too.

- I already use an ERP or CRM solution, but want to connect them to your service?

Simply register, get the API key from the admin panel and submit to your software vendor via e-mail. If your software cannot be implemented by the vendor API key, you can use our option for non-developers

The entire law on electronic invoices:

AND INTRODUCTORY PROVISIONS

Subject of law

Article 1

This law regulates the issuing, sending, reception, processing, storage, content and elements electronic invoices, in transactions between of public sector entities, between entities private sector, that is, between subjects public and private sector entities and others issues that are relevant to electronic invoicing.

The meaning of certain concepts

Article 2

Some terms used in this law have the following meaning:

1) "transaction" is a transaction with a fee, that is, a transaction without compensation between entities public sector, between private entities sector, that is, between public sector entities and a private sector entity, which refers to delivery of goods, i.e. provision of services, including advance payment;

2) "public sector subject" means the general level of the state in the sense of the law governing the budget system, that is, a public company in the sense of the law which governs public companies, which is not covered by the general state level;

3) "subject of the private sector" is the obligor value added tax, except for the public entity sector;

4) "voluntary user of electronic systems invoice" is liable for income tax from independent activities in the sense of the law which governs the income tax of citizens and taxpayers corporate income tax in the sense of the law which governs the corporate income tax, except public and private sector entities, which in reported for use in accordance with this law system of electronic invoices and to which the provisions of this law are applied accordingly apply to private sector entities;

5) "electronic invoice" is a request for payment by basis transactions with compensation, every other document that affects the payment, i.e. the amount payments, an invoice issued for sales without fees, as well as advances received, which have been issued, sent and received in a structured format which enables fully automated electronic data processing through the system electronic invoices;

6) "central information intermediary" is competent unit within the ministry responsible for financial affairs, which leads register of information intermediaries, manages system of electronic invoices and is responsible for its functioning;

7) "information intermediary" is a legal entity which, after receiving the consent of the ministry responsible for financial affairs, a public entity of the sector can, in accordance with the contract, engage for issuing, recording, processing, sending services and receiving electronic invoices and the like documentation, and the subject of the private sector i voluntary user of the electronic system invoice can in accordance with the contract hire for issuing, recording, processing, sending services, receiving and storing electronic invoices and accompanying documentation;

8) "system of electronic invoices" is the IT solution it manages central information intermediary and through whom sends, receives, records, processes and storage of electronic invoices;

9) "invoice management system" is a system for managing business processes, that is invoice verification business processes from by a multi-level public sector entity consent, and who do not own their own system or part of the invoice management system;

10) "issuer of an electronic invoice" is a subject private sector and voluntary user of the system electronic invoices, which he directly issues, sends and saves the electronic invoice through the system electronic invoices, or in whose name information intermediary in accordance with the contract issues, sends and stores through electronic systems invoice electronic invoice, as well as the subject public sector, which directly issues, sends and saves the electronic invoice, through the system electronic invoices, or in whose name information intermediary in accordance with the contract issues and sends an electronic invoice, via system of electronic invoices;

11) "recipient of electronic invoice" is the subject public sector, private sector entity and voluntary user of the electronic system invoice, which receives an electronic invoice via system of electronic invoices, i.e. in whose name information intermediary in accordance with the contract receives an electronic invoice, through the system electronic invoices;

12) "European standard of electronic of invoicing" is a standard adopted by of the European Committee for Standardization (CEN) at the basis of the order of the European Commission;

13) "Serbian electronic invoicing standard" represents a standard adopted by the national bodies for standardization in the Republic of Serbia.

Obligation to issue an electronic invoice

Article 3

The obligation to issue an electronic invoice has:

1) private sector entities based on mutual transactions;

2) subject of the private sector based on transactions with a public sector entity;

3) public sector entity based on the transaction with a private sector entity;

4) public sector entities on the basis of each other transaction;

5) tax representative of a foreign person in the Republic Serbia, in terms of tax regulations on added value, based on transactions with private and public sector subjects.

Exceptionally from paragraph 1 of this article, obligations Issuance of electronic invoice does not exist for:

1) retail sales and received advances for sales at slightly in accordance with the law that governs it fiscalization;

2) contractual obligation directed towards users funds from international framework agreements;

3) acquisition, modernization and overhaul of weapons and military equipment, procurement of security sensitive equipment, as well as related purchases goods and services.

Special obligation of electronic registration calculation of value added tax

Article 4

Obligation of electronic recording of calculations value added tax in the electronic system the invoice has the tax debtor in accordance with the law which governs the value added tax, which is liable for value added tax, as well as public sector subject, legal entity, that is an entrepreneur who is not liable for VAT value, except:

1) VAT payer for turnover goods and services performed by him, including received advance payment for that transaction, for which it issues electronic invoice in accordance with this law;

2) of the tax debtor for the import of goods.

For retail sales and received advances for sales at slightly in accordance with the law governing it fiscalization, which is carried out by the taxpayer on added value, there is an obligation to record calculation of value added tax in the system electronic invoices from paragraph 1 of this article exclusively if for that traffic, including advance received, there is no obligation to issue fiscal account in accordance with the law by which regulated by fiscalization.

Electronic recording of tax calculations on the added value from paragraph 1 of this article is carried out individually, for each obligation, and from paragraph 2. of this article collectively, for all obligations, by statement data on the base and calculated tax on added value, especially according to tax rates.

Exceptionally from paragraph 1 of this article, obligation electronic recording of tax calculation on added value in the system of electronic invoices there is also a value added tax payer for turnover of goods and services that he carries out without compensation, for who is a tax debtor in accordance with the law by which the value added tax is regulated, if for that traffic does not issue an invoice in accordance with that law.

Obligation to record calculations electronically value added tax on behalf of the person from para. 1. i 2. of this article can be transferred by contract information broker.

Electronic recording of tax calculations on added value in the system of electronic invoices it is done for the tax period within the submission deadline tax returns, in accordance with the law by which governs the value added tax.

Act of the minister responsible for financial affairs the method and procedure of the electronic are regulated more closely recording of value added tax calculations in the system of electronic invoices.

System of electronic invoices

Article 5

They must use the system of electronic invoices a public sector subject and a private subject sector in accordance with Art. 3 and 4 of this law.

A public sector entity accesses and uses the system electronic invoices for issuing, sending, receipt and storage of electronic invoices.

The subject also uses the system of electronic invoices public sector that is a contracting party in to the framework agreement that establishes the conditions and way of awarding the contract during the validity period of the framework agreement in terms of the law by which regulate public procurement, for reception, storage and inspection in dealing with electronic invoices issued during the execution of the contract concluded on the basis framework agreement.

A private sector entity accesses and benefits system of electronic invoices for issuance, sending, receiving and storing electronic invoices, directly or through an information intermediary.

Exceptionally from paragraph 1 of this article, voluntary the user of the electronic invoice system can access and use the electronic system invoice for issuing, sending, receiving and storing electronic invoices, directly or through information intermediary.

Voluntary user of electronic systems the invoice can apply to use the system electronic invoices by accessing the system electronic invoices in the manner prescribed herein by law.

In the case referred to in paragraph 6 of this article, voluntary the user of the electronic invoice system is in obliged to use the system of electronic invoices in current and next calendar year.

Using the data available in the system electronic invoices are allowed in accordance with by law.

The list of users of the electronic invoice system is public list containing tax identification numbers numbers of public sector entities, entities private sector and voluntary users systems of electronic invoices that have an obligation to receive and store the electronic invoice in accordance with this law, as well as unique numbers beneficiaries of budget funds of entities that are registered in the Register of users of public funds and which is maintained by the Central Information Office intermediaries using information and communication technology.

Act of the minister responsible for financial affairs the method of access and use are regulated more closely system of electronic invoices, as well as usage data in the sense of para. 3 and 8 of this article.

II ELECTRONIC INVOICE

Electronic invoicing standards

Article 6

An electronic invoice within the meaning of this law is issued is received in accordance with the Serbian standard electronic invoicing.

The system of electronic invoices enables immediate receipt of electronic invoices issued in accordance with European standard of electronic invoicing on the basis of a transaction in which, as the issuer electronic invoices are reported by a foreign person, and as the recipient of the electronic invoice is a public entity sector, and to all recipients of electronic invoices enables the receipt of electronic invoices via information intermediary, in accordance with the contract.

Compliance of the electronic invoice with the Serbian one electronic invoicing standard from paragraph 1. of this article implies that the electronic invoice contains basic elements from Article 7 of this law, as well as being consistent with the format and others elements of the Serbian electronic standard invoicing.

Compliance of the electronic invoice with the European one electronic invoicing standard from paragraph 2. of this article implies that the electronic invoice contains the basic elements of the European standard of electronic invoicing, as well as that it is in accordance with the format as well as other elements of European electronic invoicing standards.

Minister in charge of financial affairs closer governs the manner of application of electronic standards invoicing.

Basic elements of an electronic invoice

Article 7

The electronic invoice usually contains:

1) name, address, tax identification number and identity number of the issuer of the electronic invoice;

2) business account of the electronic invoice issuer;

3) name, address and tax identification number and the identification number of the recipient of the electronic invoice;

4) business account of the recipient of the electronic invoice;

5) serial number and date of issuance of the electronic one invoices;

6) date of delivery of the goods, i.e. provision service or advance payments;

7) amount of advance payments;

8) payment instructions;

9) data on the type and quantity of delivered goods or the type and scope of services;

10) amount of value added tax base;

11) tax rate of value added tax;

12) the amount of value added tax which is calculated on the basis;

13) the total amount of the electronic invoice;

14) note on the provision of the law governing it value added tax on the basis of which it is not calculated value added tax;

15) note that for the circulation of goods and services implements a billing system.

This law does not affect the application of the provisions of the law which regulates the calculation and payment of taxes on added value and by-laws adopted on the basis of that law, as well as on application of the provisions of the law governing it accounting in the part of the provisions governing it accounting document.

Act of the minister responsible for financial affairs the minimum electronic content is regulated more closely invoice necessary for its processing through system, cases in which certain elements electronic invoices may be omitted, cases in which an obligation is foreseen statements of additional elements, based on others regulations governing the issuance of certain type of invoices, as well as the form and method of delivery accompanying and other documentation through the system electronic invoices.

Electronic invoice as a reliable document

Article 8

Electronic invoice, in accordance with the law which the execution procedure is regulated, represents an authentic document, if it is from the issuer electronic invoice or information intermediary sent on his behalf to the electronic recipient invoices through the electronic invoice system.

III HANDLING OF ELECTRONIC INVOICES

Issuance and receipt of electronic invoices

Article 9

The issuer of the electronic invoice is obliged to issue electronic invoice in accordance with Serbian electronic invoicing standard.

The recipient of the electronic invoice is obliged to receive electronic invoice issued in accordance with Serbian electronic invoicing standard.

The recipient of the electronic invoice who is the subject public sector, is obliged to directly receive i electronic invoice issued in accordance with European electronic invoicing standard based on transaction in which it appears as the issuer foreign face.

Jobs from para. 1-3. of this article that refer to public sector entities and private entities sectors can be entrusted with information by contract mediator.

Act of the minister responsible for financial affairs the manner and procedure of registration for access to the system of electronic invoices.

Acceptance and rejection of electronic invoices

Article 10

The recipient of the electronic invoice checks the sent one electronic invoice by accessing the system electronic invoices directly or through information intermediary and accepts it or refuses within fifteen days from the day of receipt electronic invoices.

If the recipient of the electronic invoice is the subject public sector does not accept or reject electronic invoice issued by the issuer electronic invoices, directly or through information intermediary, electronic invoice se after the expiration of the term referred to in paragraph 1 of this article, he considers accepted.

If the recipient of the electronic invoice is the subject the private sector does not accept or reject issued electronic invoice, directly or through information intermediary, the recipient will, upon expiry the deadline from paragraph 1 of this article, be again notified that the electronic invoice has been issued.

If the recipient of the electronic invoice from paragraph 3. of this article does not accept or reject electronic invoice within five days from the date of receipt re-notification that it is an electronic invoice issued, electronic invoice, after the expiration of this deadline, it is considered rejected.

An electronic invoice is considered delivered to at the time of issuance in accordance with this law.

Invoice management system

Article 11

Government service responsible for design, harmonization, development and functioning of the system establishes and manages electronic administration invoice management system.

A multi-level public sector entity consent, which does not own its own system or part of the invoice management system, code business processes of electronic verification invoices, can receive electronic invoices using the invoice management system.

The manner and conditions are regulated in more detail by the act of the Government of using the invoice management system.

Central information broker

Article 12

A central information broker manages system of electronic invoices and is responsible for its functioning.

The central information intermediary manages the Registry information intermediaries who received consent of the ministry responsible for affairs of finance.

Act of the minister responsible for financial affairs the manner of action of the Central is regulated more closely information intermediary in performing tasks from st. 1. and 2. of this article.

Information broker

Article 13

For carrying out the work of an information intermediary the consent of the ministry responsible for finance affairs.

The Ministry responsible for financial affairs can revoke the consent referred to in paragraph 1 of this article.

The procedure and conditions are regulated in more detail by the act of the Government for giving and withdrawing consent for performance of information intermediary activities.

Decision of the ministry responsible for affairs of finance by which consent is given or withdrawn for carrying out the work of an information intermediary is finally on the day of adoption and against it can initiate an administrative dispute.

Subject of public sector affairs in connection with issuing, sending and receiving electronic the invoice can entrust the information broker which has the consent of the competent ministry for finance affairs.

The subject of the private sector works in connection with issuing, sending, receiving and storing can trust electronic invoices to the information intermediary that owns it consent of the ministry responsible for affairs of finance.

Obligor of electronic registration from Article 4. of this law, can entrust information intermediary and execution of a special obligation electronic recording.

The relationship between the issuer of the electronic invoice or recipient of the electronic invoice, on the one hand, and information broker, on the other hand, is governed by the contract.

The contract between the issuer of the electronic invoice and information intermediary cannot be predicted responsibility of the information intermediary for the content electronic invoices and accompanying documentation.

The information intermediary is responsible if his by providing the service of issuing, recording, processing, sending, receiving and storing electronic invoices and accompanying documentation security and functioning of electronic systems invoice.

Data Protection

Article 14

Information intermediary, central information intermediary and entities authorized to access system of electronic invoices are obliged to process personal data only for the purpose determined by this law and protect them in accordance with by the law governing the protection of data on personality.

Central information intermediary and information the intermediary is obliged to take protective measures from security risks in accordance with the law which information security is regulated.

Saving electronic invoices

Article 15

Electronic invoice issued or received by by the public sector entity is stored permanently in system of electronic invoices.

Electronic invoice issued and received by of a private sector entity shall be kept within ten years from the end of the year in which it was issued electronic invoice.

Electronic invoice issued and received by of the private sector entity is stored in the system electronic invoices or in the information system an intermediary, who is hired for custody duties by a private sector entity.

In the case of bankruptcy proceedings, liquidation or forced liquidation of information intermediary, electronic invoices which the information broker stored on behalf of of private sector entities are transferred To the central information intermediary.

Authenticity of origin and integrity of content electronic invoices are provided by her issuing until the expiry of the period until which it exists obligation to keep it.

Authenticity of origin and integrity of content electronic invoices are provided by issuing u format prescribed by this law, as well as storage in a format suitable for electronic storage documents.

The private sector entity that issued, ie received an electronic invoice can print it electronic invoice in one or more copies until the expiration of the deadline for mandatory electronic storage the invoice from paragraph 2 of this article, in the manner that ensures authenticity of provenance and integrity contents of the printed invoice.

Invoice in paper form from paragraph 7 of this article is considered authentic even after the deadline for mandatory storage of electronic invoices from paragraph 2. of this article.

The Government's act regulates the conditions and method in more detail way of storing electronic invoices ensuring credibility and integrity contents of invoices in paper form, as well as conditions and the way to view electronic invoices based on the request of the competent authority.

IV INSPECTION SUPERVISION

Performance and obligations during inspection supervision

Article 16

Inspection supervision over the implementation of this law in regarding compliance of electronic invoices with Serbian electronic invoicing standard performed by the ministry responsible for financial affairs.

On issues of inspection supervision, which are not regulated by this law, the provisions shall apply of the law regulating inspection supervision.

Article 17

Electronic invoice issuer, recipient electronic invoices, central information intermediary and information intermediary are obliged to u for the purpose of unhindered performance of inspection supervision and collection of data relevant to the performance inspection supervision over a specific entity of supervision enable the person performing the inspection supervision, insight into business data, business documentation, accompanying technical equipment and devices which are related to obligations prescribed by law.

V PENAL PROVISIONS

Article 18

With a fine in the amount of 200,000 to 2,000,000 dinars shall be fined for a violation by a legal entity - subject of the private sector, i.e. public company if:

1) violates the obligation to issue an electronic invoice (Article 3, paragraph 1);

1a) does not record value added tax electronically in accordance with this law (Article 4. st. 1, 2, 3, 4 and 6);

2) uses the data available in the system electronic invoices for purposes that are not prescribed by law (Article 5, paragraph 7);

3) does not receive an electronic invoice in accordance with this by law (Article 9, paragraphs 2 and 3).

The offense referred to in paragraph 1 of this article shall be punished entrepreneur - subject of the private sector with money with a fine in the amount of 50,000 to 500,000 dinars.

The offense referred to in paragraph 1 of this article shall be punished responsible person of a legal entity - a private entity sector, that is, a public company, in cash with a fine of 50,000 to 150,000 dinars.

Article 19

With a fine in the amount of 200,000 to 2,000,000 dinars will be fined for an information violation an intermediary who, by providing issuing services, recording, processing, sending, receiving or storing electronic invoices and accompanying documentation jeopardizes security and functioning system of electronic invoices (Article 13, paragraph 10).

The offense referred to in paragraph 1 of this article shall be punished the responsible person of the financial information intermediary with a fine in the amount of 50,000 to 150,000 dinars.

Article 20

With a fine in the amount of 200,000 to 2,000,000 dinars shall be fined for a violation by a legal entity - a private sector entity if it does not keep electronic invoice in accordance with this law (Article 15).

The offense referred to in paragraph 1 of this article shall be punished responsible person of a legal entity - a private entity sector with a fine in the amount of 50,000 to 150,000 dinars.

The offense referred to in paragraph 1 of this article shall be punished entrepreneur - subject of the private sector - with a fine in the amount of 50,000 to 500,000 dinars.

Article 21

With a fine in the amount of 200,000 to 2,000,000 the issuer will be fined dinars for the violation electronic invoices, recipient of electronic invoices and information intermediary if they do not enable to the person who performs the inspection supervision, in order unhindered performance of inspection supervision and collection of data relevant to the performance inspection supervision over a specific entity supervision, insight into business data, business documentation, accompanying technical equipment and devices which are related to the obligations prescribed by the article 17 of this law.

The offense referred to in paragraph 1 of this article shall be punished responsible person of a legal entity - a private entity sector with a fine in the amount of 50,000 to 150,000 dinars.

The offense referred to in paragraph 1 of this article shall be punished entrepreneur - subject of the private sector - with a fine in the amount of 50,000 to 500,000 dinars.

VI TRANSITIONAL AND FINAL PROVISIONS

Enactment of regulations

Article 22

By-laws provided for in this law will pass within six months of entry into force of this law.

Termination of the provisions of other laws

Article 23

The provisions of Article 2, item 9), Article 4a para. 1-4, Article 4b, Article 4c para. 1, 2 and 4, Article 4g i Article 12, para. 6-9. of the Law on Settlement Terms monetary obligations in commercial transactions ("Official Gazette of RS", no. 119/12, 68/15, 113/17 and 91/19) and Article 8, para. 1 and 3 of the Law on amendments to the Law on settlement deadlines monetary obligations in commercial transactions ("Official Gazette of the RS", number 91/19) cease to valid on April 30, 2022.

The provisions of Article 8, paragraph 2 of the Law on Amendments i amendments to the Law on payment deadlines obligations in commercial transactions ("Official glasnik RS", number 91/19) and Article 9, paragraph 3. i Article 64, paragraph 3 of the Law on Accounting ("Official Gazette of RS", number 73/19) cease to valid on the date of entry into force of this law.

Beginning of application

Article 24

The system of electronic invoices can use a public sector subject and a private subject sector after the establishment of technical and technological conditions.

Obligation of a public sector entity to receive and store electronic invoice issued in accordance herewith by law, as well as the obligation to issue electronic invoices to another public sector entity, they apply from May 1, 2022.

Obligation of a public sector entity to issue electronic invoice to a private sector entity, in accordance with this law, it applies from 1. July 2022.

Obligation of the public sector entity to electronically records the calculation of value added tax in within the meaning of Article 4 of this law, it applies from 1. May 2022.

Obligation of a private sector entity to issue electronic invoice to a public sector entity, u in accordance with this law, it applies from May 1 in 2022.

Obligation of a private sector entity to receive i keeps the electronic invoice issued by public sector entities, as well as electronic ones invoices issued by a private entity sector applies from July 1, 2022.

The provisions of this law relating to the obligation issuance and storage of electronic invoices in transactions between private sector entities they apply from January 1, 2023.

Obligation of electronic recording in connection with transactions from Article 4 of this law, except transactions in which one of the parties is the subject of the public sector, applies from January 1 in 2023.

Coming into force

Article 25

This law shall enter into force on the eighth day from publication in the "Official Gazette of the Republic of Serbia".

An independent article of the Law on Amendments and Supplements

of the Law on Electronic Invoicing

("Official Gazette of RS", No. 129/2021)

Article 6

This law enters into force on the following day publication in the "Official Gazette of the Republic of Serbia".

For all information on technical details, situations and general details about the relationship view the e-invoice list of frequently asked questions and answers.