Cancellation of e-invoices in SEF with 2 clicks

E-invoicing has become a widely adopted practice in Serbia and the entire business community, offering numerous benefits such as increased efficiency, cost savings, and more secure record-keeping. However, errors or changes in plans can sometimes occur, leading to the need to cancel an already issued e-invoice. This process is called "e-invoice cancellation." This article describes the steps for creating a cancellation e-invoice.

In order to mark an e-invoice as canceled, the issuing company must send a new e-invoice with negative values, indicating that the previous e-invoice is being canceled. The new e-invoice should clearly state that it is a cancellation e-invoice and is related to the original e-invoice being canceled. The issuing company should keep records of all e-invoices, including cancellations, for accounting and tax purposes.

When Should You Cancel an E-Invoice?

A cancellation e-invoice is a type of e-invoice used to void or revoke a previous e-invoice, with the aim of correcting any errors made in the original e-invoice. It is important to have the ability to create cancellation e-invoices, as it helps maintain accuracy and consistency in invoicing.

You may need to cancel an e-invoice for any of the following reasons:

- The e-invoice contains errors, such as incorrect quantities, wrong goods or services, or incorrect recipient information.

- The goods or services on the e-invoice were not delivered or were delivered but returned.

- The e-invoice was issued twice.

Steps for Creating a Cancellation E-Invoice

Creating a cancellation e-invoice can be faster and easier than creating a regular e-invoice. Cancel an e-invoice in just 2 clicks with e-Invoices Online.

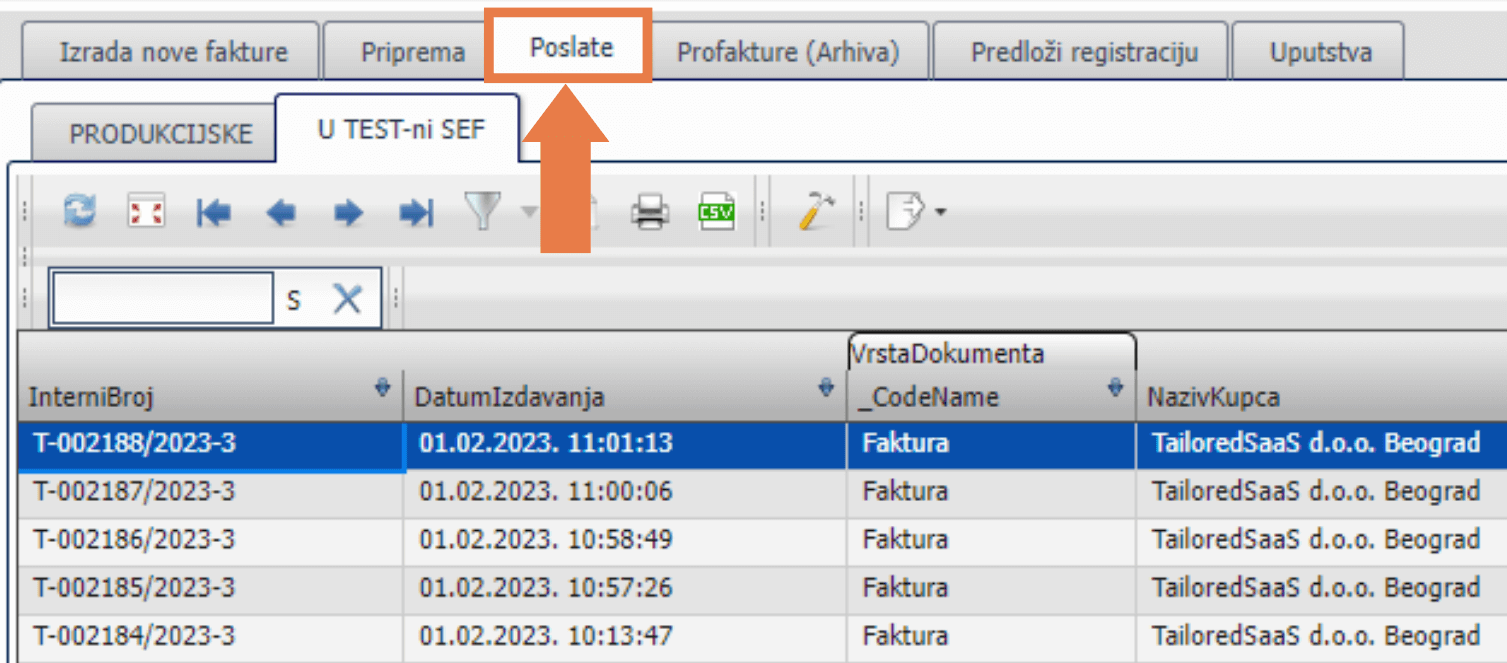

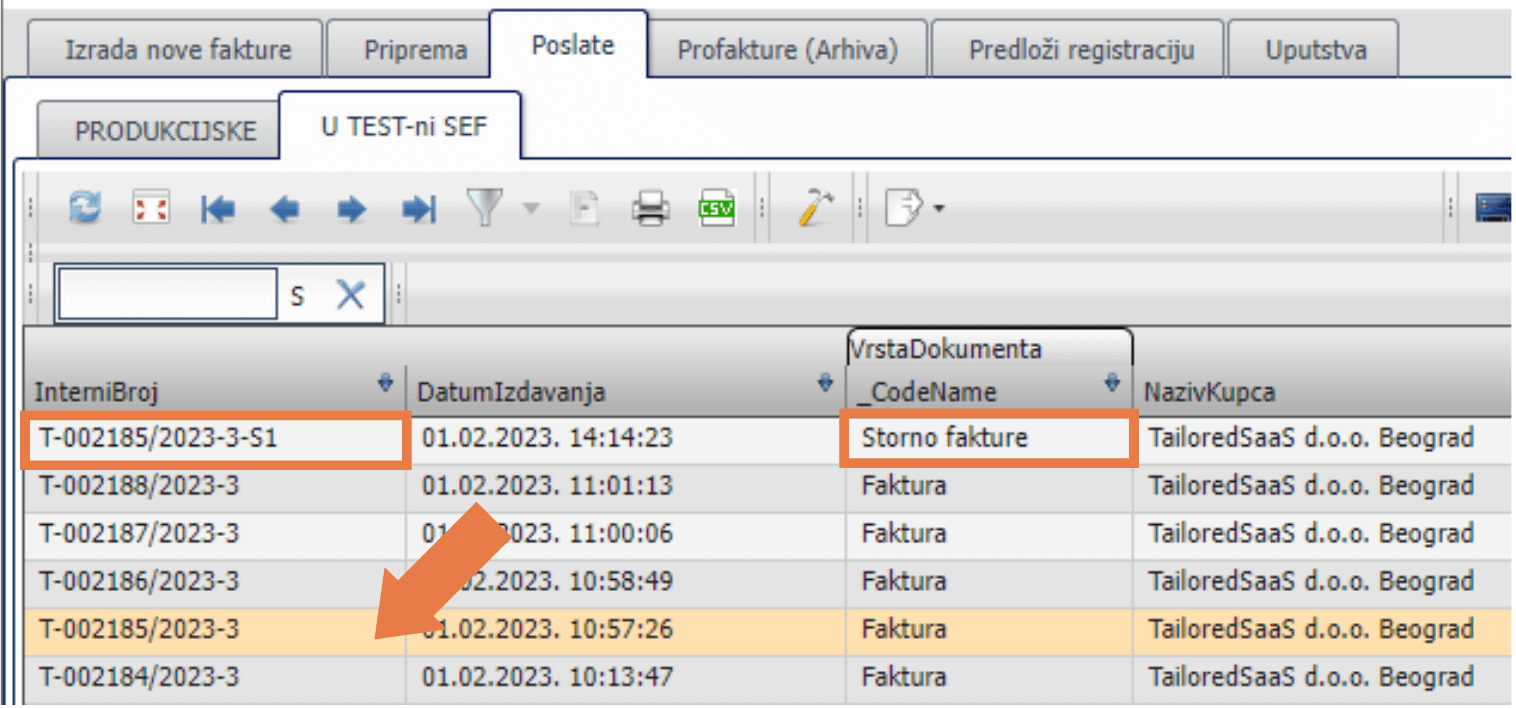

- To mark an e-invoice as canceled, you first need to find the original e-invoice you want to cancel. You will find the original e-invoice in the sent e-invoices since you sent it to SEF earlier.

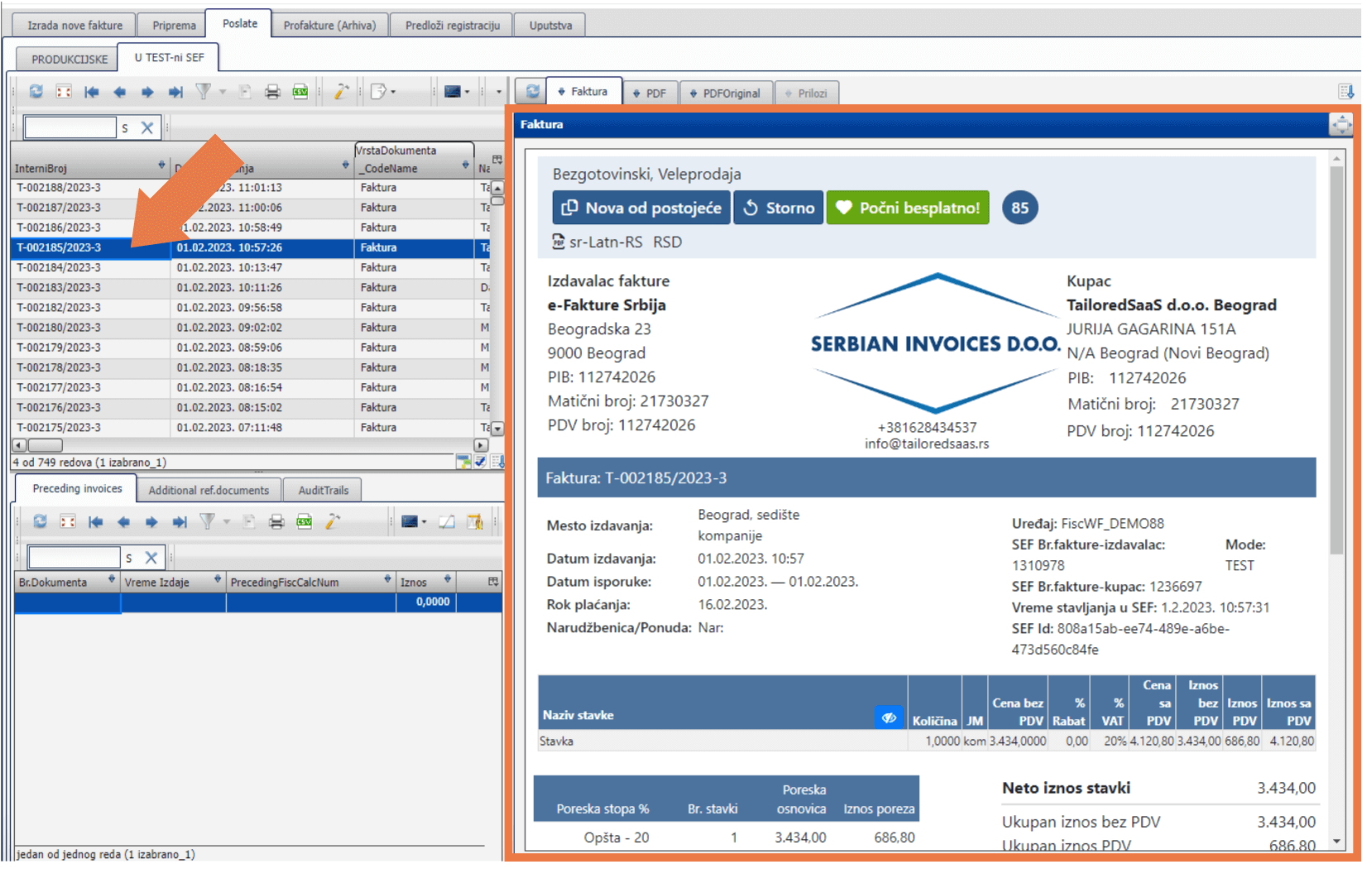

- Browse the list of sent e-invoices and click on the desired e-invoice to appear on the right panel.

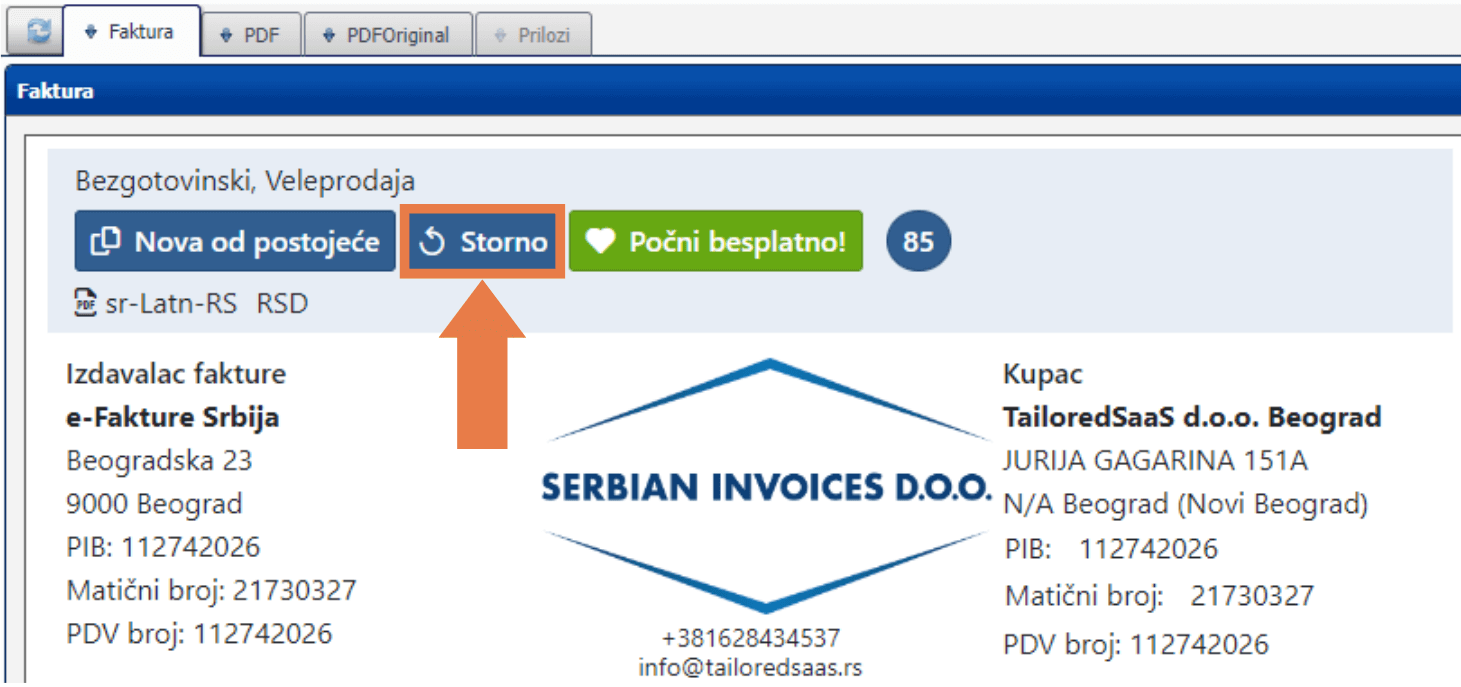

- Among the buttons at the top of the e-invoice, click 'Cancel' to cancel the e-invoice.

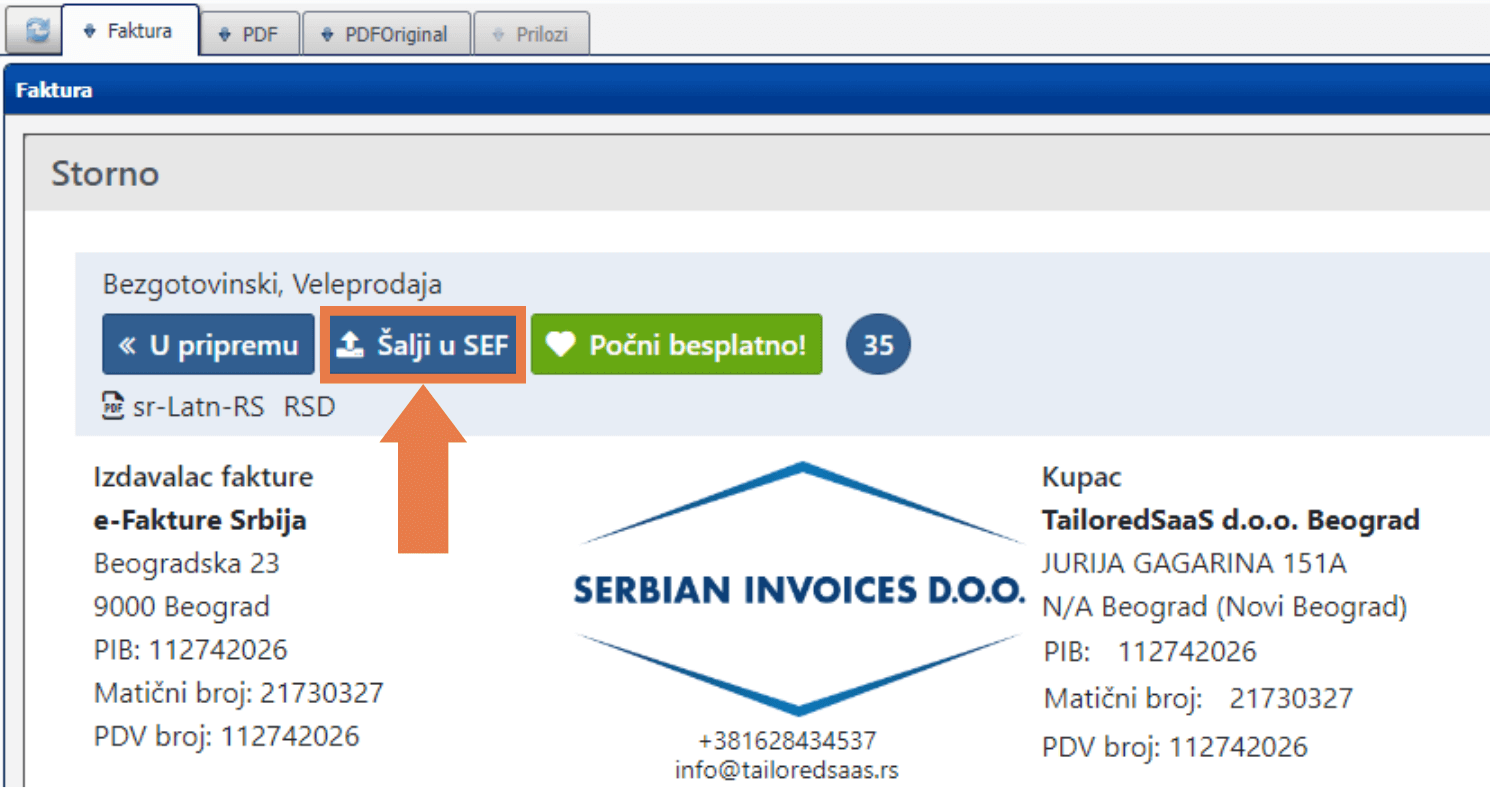

- A new cancellation e-invoice will appear. When you click 'Send to SEF,' the cancellation e-invoice is completed.

- The cancellation e-invoice will appear in yellow on the right panel after it is canceled. The internal number of the cancellation e-invoice will be the same with '-S1' added to the end, and the document type will be 'Cancellation Invoice.'

By canceling via our service, you avoid the hassle of creating an entirely new e-invoice with negative values to cancel the initial e-invoice. Instead, you can create cancellation e-invoices in a matter of seconds, with just 2 clicks.

If you want to see how it works in real-time, you can watch this quick video tutorial:

Cancellation E-Invoices in SEF

With the implementation of the Electronic Invoicing Law, e-invoicing became mandatory for most companies in Serbia. The question of how the SEF system would handle canceled e-invoices, a fundamental component of invoicing, was raised from the very beginning. Initially, it was not possible to cancel e-invoices when electronic invoicing through SEF started.

Subsequent provisions were introduced in the Electronic Invoicing Law in 2021 and 2022, changes were made in SEF, and updates to internal technical instructions made it possible to amend already issued e-invoices or even cancel them. As of June 10, 2022, this functionality has been enabled in SEF, and users are able to cancel documents in "accepted" or "rejected" status. All e-invoices, including canceled ones, are recorded in SEF, and the issuer needs to be cautious not to duplicate the mandatory VAT. For any additional questions regarding VAT obligations or e-invoicing, you can refer to our article on frequently asked questions about e-invoicing.

Importance of Cancellation E-Invoices for Businesses

The ability to cancel e-invoices is a crucial function in the invoicing of any business. With the implementation of the Electronic Invoicing Law and subsequent updates, businesses can cancel or void previously issued e-invoices through SEF by creating a new e-invoice with negative values. Alternatively, with just 2 clicks, they can cancel e-invoices in less than 10 seconds via e-Invoices Online. The ability to cancel e-invoices helps maintain the accuracy and consistency in the billing process. It's important to keep records of all e-invoices, including cancellation e-invoices, for accounting and tax purposes.

Cancel e-Invoices in 2 Clicks!

Frequently Asked Questions About Cancellation E-Invoices

- How can I cancel e-invoices?

You can cancel e-invoice in a matter of seconds by following the step-by-step instructions provided in this article.

- Can I cancel e-invoices in SEF?

Yes, you can cancel both accepted and rejected e-invoices. The easiest and quickest way to cancel them is by using e-Invoices Online, with just 2 clicks.

- How does canceling an e-invoice in SEF affect VAT?

Both the original and cancellation e-invoices will be listed in SEF; however, VAT will not be charged, as canceling effectively voids the e-invoice.