Advantages of e-invoicing

Both the issuer and recipient greatly benefit from Electronic Invoicing. Using e-invoicing has significantly improved invoice management on both ends. A highly valuable investment in invoicing software can be the first step towards complete company digitization, which is a key move towards ensuring competitiveness.

Our team of professionals is well-equipped to help your company gain all the advantages of e-invoicing, not only with public entities but also throughout your entire supply chain. If you haven't already, now is the time to invest in e-invoicing.

What is Electronic Invoicing?

Electronic invoicing, or e-invoices, is the exchange of invoices between a supplier and a buyer in an integrated electronic format. It fully automates the process of collecting invoices with data that is read and directed directly from the supplier to the buyer's AP system, regardless of the invoice format. Both suppliers and buyers can manage invoicing data on a cloud-based central platform.

Given the growing relevance of Electronic Invoicing in today's world, we have outlined some of the main benefits of using invoicing software. In this article, we will briefly explore them in the context of other commonly used alternatives. Keep reading to discover why e-invoicing is used worldwide.

Paper Invoicing

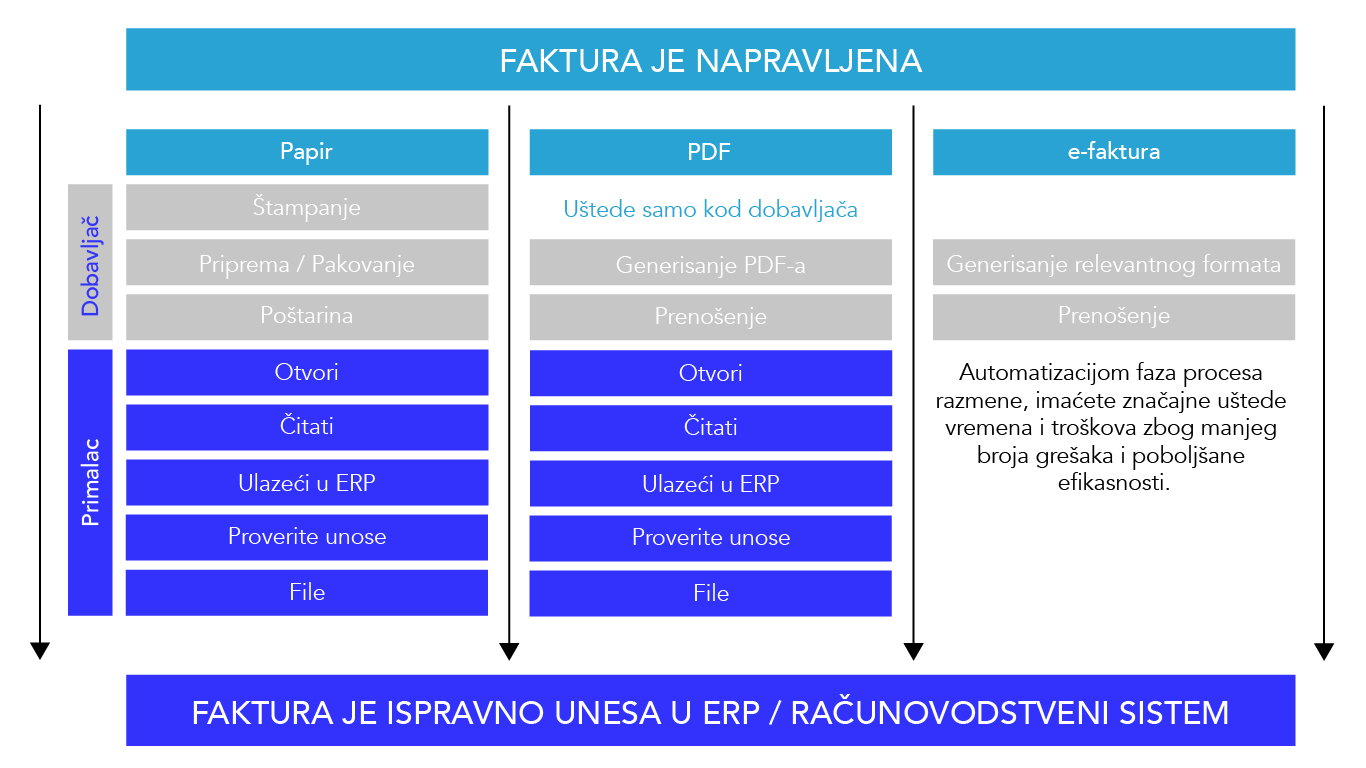

Surprisingly, a significant portion of invoices exchanged today are still paper-based versions. However, as the image below shows, this method is not only resource-intensive but also significantly more labor-intensive than e-invoicing.

The sender copies the invoice, places it in an envelope, and mails it. However, the incurred costs are not limited to postage costs. Instead, what makes the paper process expensive are the human resources involved in invoice creation, represented by personnel and infrastructure costs. The complexity and inefficiency of paper billing will be clear to anyone who has ever generated a certain number of invoices!

Surprisingly, many people blindly trust the postal service when sending invoices, assuming that the invoice will reach the recipient (which in most cases it does, of course). However, the recipient's confirmation of receipt is only available for an additional fee with traditional paper invoices.

PDF Invoicing

An increasing number of companies have transitioned from paper invoicing to PDF invoicing over the past decade. This is because a legal e-invoice is equivalent to a paper invoice and does not require, among other things, an electronic signature. PDF invoices are sent via email or made available for download instead of paper invoices. The latter is commonly used in business-to-consumer (B2C) exchanges, such as when downloading a telecommunications bill.

The effort for the sender of a PDF invoice is limited to generating the PDF (which is usually created automatically from the IT system) and sending it (which is also mostly done automatically). Of course, this represents a significant improvement over paper billing.

However, the process becomes problematic on the recipient's side as they still face the need for manual data entry, just like with a paper invoice. In other words, data cannot be automatically transferred from the PDF to the ERP/accounting system. Instead, the recipient must enter the data manually or copy it over.

The PDF format itself is the cause of this. Unfortunately, many people believe that e-invoicing includes PDF invoicing. However, this is incorrect because PDFs are designed to be human-readable, not as a structured document format that can be processed programmatically. For automated document exchange, formats like XML, CSV, or EDIFACT are much more suitable.

E-Invoicing

The sender creates an electronic invoice and delivers it to the recipient's invoicing software in a format that can be processed programmatically (such as EDIFACT or XML). The invoicing software there automatically processes the electronic invoice, making it immediately ready for further processing elsewhere (e.g., invoice verification and approval).

Unlike paper or PDF invoices, the process can be fully automated without the need for any manual processes.

In addition, as soon as the recipient receives the invoice, the sender (depending on the technical protocol used for invoice transmission) receives the appropriate acknowledgment.

How do these three approaches actually compare?

The processes related to sending and receiving different types of invoices are shown in the diagram below:

Key Benefits of E-Invoicing

Time, Delivery Costs, and Staff Savings

It completely avoids going through the cumbersome paper invoicing process, including printing and mailing. It is now possible to allocate staff who previously handled invoicing to other tasks. This way, the corporation can free up resources and time for investment in more critical business phases. Since data from the e-invoice can be automatically forwarded to the ERP/accounting system, the recipient is relieved from manually processing the received invoice.

Reduced Material Costs

Physical goods include costs for buying paper, envelopes, printer cartridges, postage stamps, as well as money for the printer and its maintenance.

Quicker Payments Due to Faster Processing

Payment terms for invoices typically start counting as soon as you receive them. Early and (ideally) timely payment resulting from the quick availability of electronic invoices to the recipient.

Reduced Data Entry Errors

Data entry errors are significantly reduced due to the ongoing automation of the e-invoicing process and the elimination of manual typing.

Simplified Archiving

Companies are legally required to keep invoices in records in case tax authorities conduct audits later on. The duration varies from one country to another (usually between 5 and 10 years). Printed invoices are usually not good candidates for long-term archiving. Archived invoices can be lost due to fire or floods. The invoice data is already available with e-invoicing in the case of electronic invoicing transmission, making it relatively easy to integrate into an electronic archiving system. Data mapping and appropriate backups, which are features of modern archiving systems, ensure that invoice data is secure and easily accessible.

Green Initiative

By transitioning to electronic invoicing, you can eliminate the need for paper printing. You can reduce costs and waste associated with paper supply chain activities, while also making them more energy-efficient.

Don't wait, switch to e-invoices today

Frequently Asked Questions

- When is the right time to switch to e-invoicing?

If you haven't already, now is the time to invest in e-invoicing and elevate your business as governments around the world, including the Serbian government in this case, have introduced legal obligations and are working on establishing electronic invoicing.

- How important is the transition to e-invoicing?

One of the most crucial strategic initiatives that companies undertake for process digitization is e-invoicing.

- What is the main advantage of electronic invoicing?

The main advantage is saving time, delivery costs, and staff resources.

For all technical details, situations, and general information about e-invoices, please review the list of frequently asked questions and answers.